Leede Insights for 07/25/25

- nhayer9

- Jul 31, 2025

- 5 min read

Wealth Management

Colliers (NASDAQ, TSX: CIGI) announced

It has completed its previously announced acquisition of a controlling interest in Astris Infrastructure, LLC (“Astris Finance”), a global investment banking firm specializing in infrastructure and energy transition.

The acquisition significantly expands Colliers’ investment banking capabilities and capitalizes on the growing global demand for infrastructure that supports urbanization, energy security, and decarbonization.

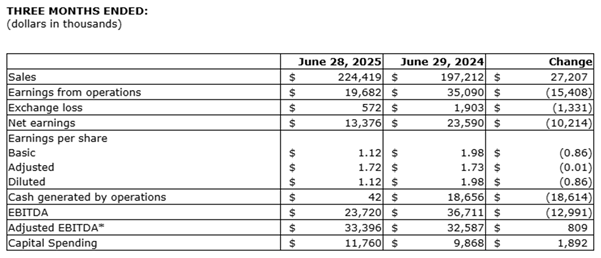

Hammond Power Solutions Inc. (TSX: HPS.A) announced its financial results for the second quarter 2025.

Record sales of $224 million in the quarter, a 13.8% increase vs quarter 2, 2024.

Adjusted EBITDA of $33 million in the quarter, or 14.9% of sales.

Gross margin was $68 million or 30.7% of sales.

Net earnings of $13.4 million in the quarter, significantly impacted by share-based compensation.

Adjusted earnings per share of $1.72.

Earnings per share of $1.12.

Due to record sales, backlog is lower by 8% vs the first quarter of 2025 but remains 9% higher vs the end of 2024.

Ovintiv Inc. (TSX: OVV) announced its second quarter 2025 financial and operating results.

Generated cash from operating activities of $1,013 million, Non-GAAP Cash Flow of $913 million and Non-GAAP Free Cash Flow of $392 million after capital expenditures of $521 million

Second quarter production was above the guidance range on every product with average total production volumes of 615 MBOE/d, including 211 Mbbls/d of oil and condensate, 96 Mbbls/d of other NGLs (C2 to C4) and 1,851 MMcf/d of natural gas

Reduced Net Debt by $217 million during the quarter to approximately $5.31 billion

Returned $223 million to shareholders through the combination of base dividend payments and share buybacks

Raised full year production guidance to a range of 600 MBOE/d to 620 MBOE/d, including oil and condensate of 205 Mbbls/d to 209 Mbbls/d and natural gas of 1,825 MMcf/d to 1,875 MMcf/d

Full year capital guidance range lowered to $2.125 billion to $2.175 billion, $50 million lower at the midpoint

Pembina Pipeline Corp. (TSX: PPL) has reached a negotiated settlement with shippers and interested parties on the Canadian portion of the Alliance pipeline and filed an application with the Canada Energy Regulator (CER) seeking approval of the settlement.

Separately, Alliance announced it is soliciting non-binding expressions of interest for a new regional short-haul transportation service.

Highlights of the settlement include:

A 10-year term, effective Nov. 1, 2025, through to Oct. 31, 2035;

A revised term-differentiated toll schedule that includes the establishment of a new 10-year toll and a reduction to the existing one-year, three-year and five-year tolls. The new tolls are expected to reduce existing long-term firm tolls by an average of 14% on a volume weighted average basis;

All existing long-term firm service contracts will incorporate the new tolls, and the new tolls will remain fixed for the 10-year period effective Nov. 1, 2025;

The settlement offers existing long-term firm shippers a one-time term extension option, enabling shippers to take advantage of the new term-differentiated tolls, effective Nov. 1, 2025. Alliance anticipates a significant portion of contracted volumes to take advantage of the 10-year toll, thereby extending the weighted average term of Alliance's contractual profile;

Speculative Stocks

BriaCell Therapeutics Corp. (TSX: BCT) a clinical-stage biotechnology company that develops novel immunotherapies to transform cancer care, announces two clinical data poster presentations at the European Society for Medical Oncology (ESMO) Congress 2025 Annual Meeting taking place October 17 – 21 in Berlin, Germany.

The titles of the poster presentations are listed below.

Abstracts will be published online via the ESMO website at 00:05 CEST on October 13th 2025 (6:05 pm ET on October 12th).

Charts of the Day

Retail

CMHC Housing Outlook for Canada

Housing activity has weakened since January. Many home buyers and developers are taking a “wait‑and‑see” approach amid weaker economic growth and lingering trade tensions. Resale markets have softened, especially in Ontario and British Columbia, while Alberta shows signs of cooling. Quebec’s housing activity has slowed less than in other parts of Canada, supported by more market momentum and more stable buyer sentiment. Overall, our current housing forecast in 2025 is increasingly aligned with the Housing Market Outlook’s low scenario in the near term which highlights growing downside risks to the outlook.

Home prices are drifting lower in areas where demand has weakened, and listings have increased. We now expect the Canadian average home price to decline by about 2% this year, with larger drops in Ontario and British Columbia where high prices and reduced investor activity in the condominium market continue to weigh on demand. We expect a recovery in 2026 as economic fundamentals and confidence improve. However, housing starts are likely to respond more slowly, as developers remain cautious and financing conditions stay tight.

Multi-unit construction will remain elevated by historical standards, but regional variations will remain. Construction will generally stay strong in Atlantic Canada, the Prairies and Quebec. In contrast, starts will decline sharply in Ontario and British Columbia, where high housing prices, rising construction costs and low investor confidence are weighing heavily on new builds, especially condos. Many condo projects are delayed, cancelled or converted to rentals. Developers are missing presale targets, and unsold inventory is rising. Falling prices and tighter credit are creating risks for buyers. These challenges are likely to persist through 2025.

Low-rise construction will face similar challenges, particularly in Ontario. However, modest gains are expected in Quebec, Manitoba and Alberta. Semi-detached and row housing are proving more resilient in regions such as British Columbia.

Rental conditions will continue to ease gradually throughout the forecast period as elevated levels of new supply come online, and demand softens. A surge in rental and condo completions is pushing vacancy rates slightly higher in Canada’s major centres. Although rents continue to rise, increases are smaller than in recent years. Slower household formation, lower immigration and weaker labour markets are also putting downward pressure on rental demand.

The lack of affordability is still a major barrier for many prospective homebuyers, especially in higher-cost markets. Mortgage costs are expected to remain elevated, even with modest policy rate cuts, offering little relief to buyers. This is due to the return of mortgage rates to their historical spread above the Bank of Canada’s policy rate, after a period of unusually low spreads. Ongoing tariffs on steel, lumber and other construction materials are also keeping building costs high, hindering housing supply. The result is a near-term environment where many households are still priced out and builders are hesitant to break ground.

Canada’s housing market is in a period of adjustment. The combination of weaker economic growth, reduced population inflows and ongoing trade-related uncertainty is creating a softer market environment in 2025. However, we expect conditions to stabilize more in 2026 as trade tensions ease, mortgage rates moderate and demand slowly recovers. As the economic environment improves, the housing market should gradually return to a more balanced trajectory.

Source: CMHC

Economics

US Durable Goods Order for June

Durable goods orders in the US declined 9.3% month-over-month to $311.84 billion in June 2025, reversing an upwardly revised 16.5% jump in May.

The biggest decline was seen in orders for transport equipment (-22.4%), mostly nondefense aircraft and parts (-51.8%) and capital goods (-22.2%), mainly nondefense (-24). Excluding transportation, new orders rose 0.2% and excluding defense, orders edged up 0.1%.

Increases were seen in orders for fabricated metal products (0.2%), machinery (0.4%), primary metals (0.6%) and computers and electronics (0.6%).

Meanwhile, orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, declined 0.7%, following an upwardly revised 2% advance in May and compared to forecasts of a 0.2% rise.

Source: Trading Economics, U.S. Census Bureau