Leede Insights for 07/29/25

- nhayer9

- Jul 31, 2025

- 9 min read

Wealth Management

George Weston Limited (TSX: WN) approved a stock split of the outstanding common shares and announced results.

The split will be implemented by way of a stock dividend where Weston will issue to shareholders two additional Common Shares for each Common Share held (i.e. a three-for-one stock split).

The stock split will be effective at the close of business on August 18, 2025 to shareholders of record at the close of business on August 14, 2025.

Weston is undertaking the stock split to ensure their Common Shares remain accessible to retail investors and employees who participate in the Employee Share Ownership Plan, and to improve the liquidity of the Common Shares.

The stock split will not dilute shareholders' equity.

As the aggregate declared amount of the stock dividend on the Common Shares is nominal, there will be no Canadian income tax payable by shareholders related to this transaction.

The Common Shares will begin trading ex-dividend (post-split) on the Toronto Stock Exchange at the opening of business on August 19, 2025.

Common shares will trade on a "due bill" basis from the opening of business on August 14, 2025, until the close of business on August 18, 2025, inclusively, where shares will carry the right to receive the additional shares to be issued in connection with the stock dividend.

Revenue was $14,823 million, an increase of $732 million, or 5.2%.

Adjusted EBITDA was $1,923 million, an increase of $117 million, or 6.5%.

Net earnings available to common shareholders were $258 million ($1.96 per common share), compared to $400 million ($2.97 per common share) in the same period in 2024.

Adjusted net earnings available to common shareholders were $401 million, an increase of $7 million, or 1.8%.

Contribution to adjusted net earnings available to common shareholders from the publicly traded operating companies was $443 million, an increase of $17 million, or 4%.

Adjusted diluted net earnings per common share were $3.06 , an increase of $0.13 per common share, or 4.4%.

Repurchased for cancellation 1.1 million common shares at a cost of $295 million.

GWL Corporate free cash flow was $293 million.

Gibson Energy Inc. (TSX: GEI) announced results for the three months ended June 30, 2025.

Infrastructure Adjusted EBITDA of $153 million.

Marketing Adjusted EBITDA of $8 million.

Net income of $61 million, a $3 million decrease.

Distributable Cash Flow of $81 million, a $20 million decrease.

Dividend Payout ratio on a trailing twelve-month basis of 83%, modestly above the 70% – 80% target range.

Net debt to Adjusted EBITDA ratio of 4.0x at June 30, 2025 compared to 3.5x at June 30, 2024.

SECURE Waste Infrastructure Corp. (TSX: SES) reported results for the three months ended June 30, 2025.

Generated revenue (excluding oil purchase and resale) of $353 million, up 5% from Q2/24.

Recorded Adjusted EBITDA of $110 million ($0.49 per basic share), representing a 4% year-over-year decrease (14% increase on a per share basis).

Recorded net income of $31 million ($0.14 per basic share), relatively flat from Q2/24 on an absolute basis, and up 17% on a per share basis due to the share buybacks over the past year reducing the weighted average shares outstanding in the quarter by 15%.

Repurchased approximately 9.4 million common shares at $14.50 per share for $136 million under the Corporation's Substantial Issuer Bid (SIB).

Also repurchased approximately 1.7 million common shares under the Corporation's Normal Course Issuer Bid (NCIB) for $25 million.

Surge Energy Inc. (TSX: SGY) announced results for the quarter ended June 30, 2025.

Higher than budgeted average daily production of 23,589 boepd (89% liquids).

Generated $72.8 million of AFF, with WTI crude oil prices averaging US $63.88 per barrel.

Decreased net operating expenses by 16% over the past year, from $20.31 per boe in Q2/24 to $17.08 per boe in Q2/25;

Drilled 5 gross (5 net) wells in the quarter.

Decreased net debt by $16.9 million, from $246 million in Q1/25, to $229.1 million.

Returned an additional $2.2 million to shareholders by way of the NCIB.

On an annualized basis, Q2/25 AFF represented 0.79 times Q2/25 net debt of $229.1 million; and

The $250 million first lien credit facility remained undrawn as at June 30, 2025, providing Surge with substantial available liquidity.

Topaz Energy Corp. (TSX: TPZ) provided second quarter 2025 financial results.

Topaz generated total revenue and other income of $81.2 million , 46% from crude and heavy oil royalties, 26% from natural gas and NGL royalties, and 28% from the infrastructure portfolio.

Generated cash flow of $75.6 million ($0.49 per share) and free cash flow (FCF) of $74 million ($0.48 per share).

19% higher royalty production (22,290 boe/d) from the prior year, including 9% higher crude and heavy oil royalty production and 23% higher natural gas and natural gas liquids royalty production.

Approximately 70% of the annual production growth is attributed to royalty acquisitions completed during the prior two quarters.

Topaz's share of total WCSB drilling activity across the royalty acreage increased from 15% during Q2/24 to 21% during Q2/25.

125 gross wells (4.9 net) were drilled, and 5 gross wells were reactivated during the quarter despite spring break-up seasonality that typically limits development activity.

Processing revenue of $20.2 million from Topaz's infrastructure assets increased 37% from the prior year.

Paid the increased second quarter dividend of $0.34 per share (69% payout ratio) and approved the third quarter dividend of $0.34 per share which represents a 5.3% annualized yield to Topaz's current share price.

Allocated $26 million of Excess FCF toward the previously announced Alberta Montney infrastructure acquisition which closed on May 30, 2025.

Speculative Stocks

Air Canada (TSX: AC) reported second quarter 2025 financial results.

Operating revenues of $5.632 billion, an increase of 2% versus last year.

Operating income of $418 million with operating margin of 7.4% and adjusted EBITDA of $909 million with adjusted EBITDA margin of 16.1%.

Premium revenues up 5% from the second quarter of 2024.

Cash flow from operating activities of $895 million and free cash flow of $183 million.

Completion of $500 million substantial issuer bid, with approximately 296 million total issued and outstanding shares on June 30, 2025.

Leverage ratio of 1.4 at June 30, 2025.

Ashley Gold Corp. (CSE: ASHL) announced a closing of tranche 1 for gross proceeds of $136,890.

The first tranche consisted of the issuance of 2,040,000 FT shares and 775,333 NFT shares for gross proceeds of $136,890.00.

They intend to use the gross proceeds of the FT Offering to incur "Canadian exploration expenses"

Elemental Altus Royalties Corp. (TSXV: ELE) acknowledged the receipt of regulatory approval by Capricorn Metals Limited (ASX: CMM) for the full development of the Karlawinda Expansion Project in Western Australia.

The expansion is expected to increase annual gold production by approximately 25% to 150,000 ounces per annum. Elemental Altus holds an uncapped 2% net smelter return (NSR) royalty.

On completion of the expansion in 2026, Elemental Altus to benefit from approximately 25% higher production at their cornerstone Karlawinda royalty at no cost.

Capricorn Metals has received formal approval for development of the Karlawinda Expansion Project from the Western Australian Department of Energy, Mines, Industry Regulation and Safety.

Capricorn plans to increase mill throughput at Karlawinda from 4Mtpa to 6.5Mtpa.

Construction of the 164-room camp expansion largely complete and early clearing and earthworks associated with the expansion have commenced.

The expansion plans include additional open pits, new crushing and ball mill circuits, and additional infrastructure upgrades.

Faraday Copper Corp. (TSX: FDY) has completed their previously announced brokered bought deal financing, including the exercise in full of the Underwriters' over-allotment option, for a total of 26,139,500 common shares sold at a price of $1.10 per Common Share for aggregate gross proceeds of $28,753,450, concurrently with a non-brokered private placement of 18,200,000 Common Shares sold at a price of $1.10 per Common Share for additional gross proceeds of $20,020,000.

Collectively, 44,339,500 Common Shares were sold at a price of $1.10 per Common Share for total gross process of $48,773,450.

Oncolytics Biotech ® Inc. (TSX: ONC) has initiated regulatory discussions with the U.S. FDA for a potential registration-enabled pivotal study in first-line metastatic pancreatic ductal adenocarcinoma (mPDAC).

Assuming discussions with the FDA go as expected, they expect to commence study start-up activities before the end of 2025.

This milestone reflects Oncolytics' conviction in pelareorep's differentiated mechanism of action and its encouraging survival signal in one of the most lethal and underserved solid tumors.

The FDA interaction will focus on finalizing a clinical trial design that leverages pelareorep's demonstrated synergy with chemotherapy with or without checkpoint inhibition, and overall survival as the primary endpoint.

Among the potential options, Oncolytics will consider proposing an adaptive study in collaboration with a third party.

Questerre Energy Corporation (TSX: QEC) has entered into a definitive agreement to acquire 100% of Parana Xisto SA, a privately held shale oil production and refining company based in southern Brazil by way of acquisition of the shares of their indirect parent companies, Forbes & Manhattan Resources Inc. (Private) and Forbes Participaҫões Ltda (Private).

Assets acquired: PX Energy currently produces approximately 4,500 boe per day, with a targeted increase to 6,000 boe per day by August 31, 2026, supported by growth capital projects currently underway.

Purchase consideration: 65 million common shares of Questerre, structured as follows:

15 million common shares issued upon closing, which will be subject to a voting and lock-up agreement;

50 million common shares, released in two tranches based on the achievement of key performance milestones:

With respect to the first tranche of 25 million common shares, US$30 million Free Cash Flow achieved no later than September 30, 2027, with respect to the second tranche of 25 million common shares, US $40 million Free Cash Flow achieved no later than September 30, 2028; or

Equity financings completed at or above $0.50 per share with respect to the first tranche for aggregate proceeds of at least $25 million completed no later than September 30, 2027 and with respect to the second tranche, an equity financing at or above $1 per share for aggregate proceeds of at least $25 million no later than September 30, 2028.

Quebec asset spin-out: It is anticipated that Questerre’s Quebec-based assets will be transferred into a separate sidecar subsidiary company.

Questerre anticipates either distributing preferred shares of Questerre or of the new entity to its existing shareholders ahead of the closing of the acquisition of PX Energy in order not to dilute its existing shareholders’ position in the Quebec Assets.

Thiogenesis Therapeutics Corp. (TSXV: TTI) has.

Increased the size of a previously announced non-brokered private placement from 2 million to 5.3 common shares at a price of $0.75 per Common Share for gross proceeds of approximately $4 million.

Charts of the Day

Economics

Are Canadian labour stats to good to be true?

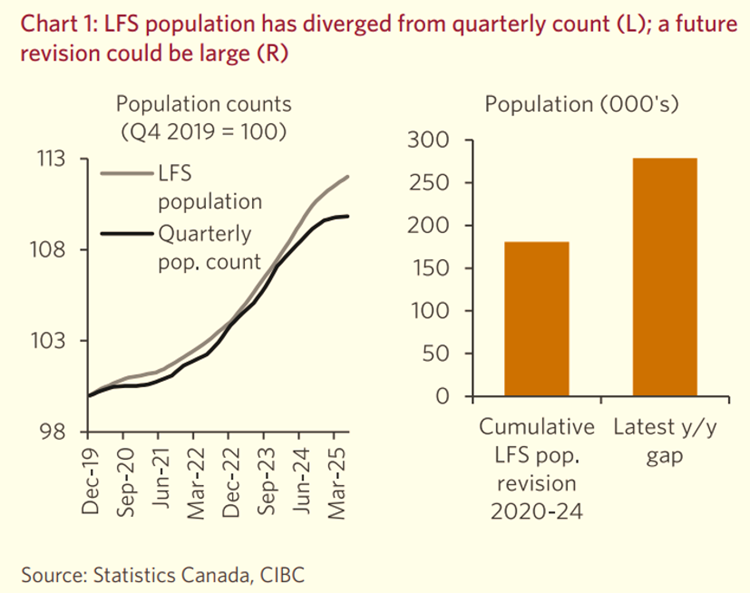

Job growth appears to be accelerating again and the unemployment rate has barely increased since trade uncertainties flared up earlier this year. It seems too good to be true. Unfortunately, that’s probably because it is. There’s ample reason to question whether employment growth has really been as strong as suggested by the widely followed Labour Force Survey (LFS), while the rise in unemployment may actually be largely unrelated to the struggles of the manufacturing and other trade-sensitive sectors.

If the Canadian labour market is weaker than advertised, this slack should eventually place downward pressure on core measures of inflation and bring a couple more interest rate cuts from the Bank of Canada later this year.

A key reason for continued strength in the LFS employment count could be the fact that the base population in that survey has slowed less than that seen within the quarterly population data. While population data in the LFS can and will differ at times because it only counts working age persons, it can also be prone to future revision particularly during times when accelerations/decelerations are being driven by non-permanent residents (NPR’s).

In fact, earlier this year, a rebasing of the LFS resulted in upwards revisions to population and employment counts between 2020 and 2024. That was a period of time when NPR’S were generally rising as a share of the population and the LFS population count had lagged the quarterly figures.

Today the opposite is true, with the quarterly population count decelerating sharply largely because of the impact of NPR’s. In this situation the LFS population figures (and by extension employment growth) may end up being revised downwards at some point in the future. How much? Judging by the gap that has opened up recently between the LFS and quarterly population figures, the revision could be significant. In fact, the gap that has opened up in just one year is larger than the cumulative upward revision seen between 2020 and 2024 mentioned previously.

Source: CIBC Economics

Markets

Speaking of labour demand - look at what it will take to expand growth in the renewable power sector

For power sectors to expand their base of renewables, they'll need more workers. Renewable sources of power are over 2.5 times more labor-intensive than fossil fuels on average across their lifecycle, from manufacturing through construction and installation to operations and maintenance.

Further labor demand will come from the transmission and distribution industries—especially since renewable energy sources are often located farther from the areas they serve.

To meet the 300 gigawatts of additional power generation capacity by 2030 expected in the US, Goldman Sachs Research estimates suggest that 207,000 additional electricity transmission and interconnection workers will be needed.

Manufacturing, construction, and operations of power technologies in the US will need another 300,000 jobs. In Europe, our analysts estimate that around 250,000 incremental jobs in power generation are required by 2030.

Source: Goldman Sachs

Canadian Renewable IPP valuations

On average, renewable IPP equities have outperformed broader indices since late-January. Equities in our coverage set have improved 33% since respective Q1/25 floors and rallied 11% during Q2/25. Average Q2 share price improvement outpaced the 8% increase for the S&P/TSX Composite and a 1% average increase for large-cap Canadian utilities. We attribute better sector performance to

ongoing sector M&A activity at attractive implied valuation terms,

a growing global power supply deficit, with positive implications for corporate contract price terms, and

several company-specific growth/asset recycling initiatives that showcase companies' nimble approach to portfolio optimization.

Valuations are expanding from depressed troughs. Based on forward EV/EBITDA, the average Canadian renewable IPP multiple has increased to 11.3x - below the long-term average of 13.2x, but up from the Q1/25 trough of 10.0x. On other metrics, we believe that valuations are approaching fair levels; the trailing FCF yield for our coverage set is 4.6% - inline with the long-term average, but the 108 basis point premium to the Canadian 10-year has narrowed in recent months.

Source: TD Cowan